What is a DSCR (Debt Service Coverage Ratio)?

A DSCR (Debt Service Coverage Ratio) loan is a type of non-qualified mortgage (non-QM) loan designed specifically for real estate investors. Instead of relying on personal income verification, this loan evaluates the property’s cash flow to determine eligibility. The DSCR measures how much cash flow the investment property generates to cover its debt obligations, including mortgage payments and other expenses.

How Does a DSCR Loan Work?

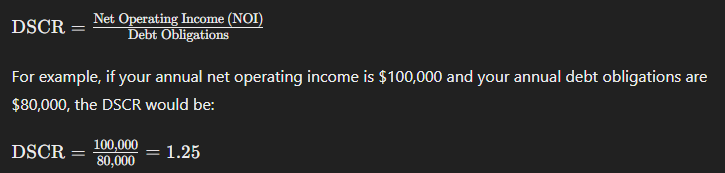

DSCR loans are unique in that they do not require the borrower to submit personal income documentation, such as tax returns or pay stubs. Instead, lenders evaluate the property’s income potential. To qualify, the property must generate sufficient rental income to cover the mortgage and associated costs. This is reflected in the debt service coverage ratio, which is calculated by dividing the property’s net operating income (NOI) by its total debt obligations.

For example, if a property generates $100,000 in annual net operating income and has $80,000 in annual debt obligations, the DSCR would be 1.25. This indicates the property generates 25% more income than is needed to cover its expenses, which is considered favorable.

How to Qualify for a DSCR Loan:

Qualifying for a DSCR loan is relatively straightforward. The key factors include:

- Property Income: The rental income from the property must be sufficient to cover the mortgage and any associated expenses.

- Minimum DSCR: Lenders typically require a minimum DSCR of between 1.1x and 1.2x, meaning the property should generate at least 10% to 20% more income than the total debt obligations.

- Credit Score: Borrowers usually need a minimum FICO score of 700 to qualify.

- Loan Amount: The minimum loan amount required is typically $175,000.

How is DSCR Calculated?

The debt service coverage ratio is calculated using this formula:

This means the property generates 25% more income than necessary to cover the debt payments.

What is a Good DSCR?

A DSCR of 1.0 means that the property generates just enough income to cover its expenses, including mortgage payments. However, lenders usually prefer a DSCR greater than 1.2, which indicates the property has enough income to comfortably cover its obligations and leave room for profit. For most residential investment properties, a DSCR of 1.2 or higher is considered ideal.

Long-Term Rental DSCR Loan Requirements:

- No personal income documents required.

- Qualification is based on the cash flow of the property.

- Minimum DSCR: 1.0x

- Maximum loan-to-value (LTV) ratio: 80%

- Minimum FICO score: 700

- Eligible property types: 1-2 family homes and warrantable condos.

- Fixed-rate loans available.

- No prepayment penalties.

- Minimum loan amount: $175,000.

Short-Term Rental (STR) DSCR Loan Requirements:

- No personal income documents required.

- Qualification is based on the cash flow of the property.

- Minimum DSCR: 1.0x

- Maximum loan-to-value (LTV) ratio: 75%

- Minimum FICO score: 700

- Eligible property types: 1-2 family homes and warrantable condos.

- Fixed-rate loans available.

- No prepayment penalties.

- Minimum loan amount: $175,000.

Why Choose a DSCR Loan?

A DSCR loan offers real estate investors a flexible and efficient way to finance rental properties without the hassle of personal income verification. It’s an attractive option for experienced investors who focus on cash flow from rental income. With competitive terms and the ability to leverage rental properties as collateral, DSCR loans are an excellent tool for expanding a real estate portfolio while keeping personal finances separate from the investment.

It is important to consult with your experienced and knowledgeable Go-To Mortgage Advisor, Dustin Dumestre (Brokered Loan Officer).